Business, 11.01.2020 03:31 cxttiemsp021

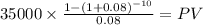

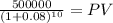

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, barnett corporation sold bonds with a face value of $500,000 and a coupon rate of 7 percent. the bonds mature in 10 years and pay interest annually on december 31. barnett uses the effective interest amortization method. ignore any tax effects. each case is independent of the other cases

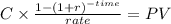

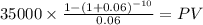

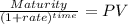

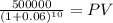

required: complete the following table. the interest rates provided are the annual market rate of interest on the date the bonds were issued. case a (7%) case b (8%) case c (6%)

a. cash received at issuance

b. interest expense recorded in year 1

c. cash paid for interest in year 1 4. cash paid at maturity for bond principal

Answers: 2

Another question on Business

Business, 21.06.2019 13:00

As you start to review the various career options available to you, you will notice that not every career will require what?

Answers: 2

Business, 22.06.2019 08:20

Suppose that jim plans to borrow money for an education at texas a& m university. jim will need to borrow $25,000 at the end of each year for the next five years (total=$125,000). jim wishes his parents could pay for his education but they can’t. at least, he qualifies for government loans with a reduced interest rate while he is in school. he has a special arrangement with aggiebank to lend him the money at a subsidized rate of 1% over five years without having to make a payment until the end of the fifth year. however, at the end of the fifth year, jim agrees to pay off the loan by borrowing from longhorn bank. longhorn bank will lend him the money he needs at an annual interest rate of 6%. jim agrees to pay back the longhorn bank with 20 annual payments and the payments will be uniform (equal annual payments including principal and interest). (i) calculate how much money jim has to borrow at the end of 5 years to pay off the loan with aggiebank. a. $121,336 b. $127,525 c. $125,000 d. $102,020 e. none of the above

Answers: 2

Business, 22.06.2019 09:00

Drag the tiles to the correct boxes to complete the pairs.(there's not just one answer)match each online banking security practice with the pci security requirement that mandates it.1. encrypting transfer of card data2. installing a firewall3. installing antivirus software4. assigning unique ids and user namesa. vulnerability management programb. credit card data protectionc. strong access controlsd. secure network

Answers: 3

Business, 22.06.2019 10:00

Cynthia is a hospitality worker in the lodging industry who prefers to cater to small groups of people. she might want to open a

Answers: 3

You know the right answer?

Comparing bonds issued at par, at a discount, and at a premium (ap10-2) on january 1 of this year, b...

Questions

Physics, 03.02.2021 01:00

English, 03.02.2021 01:00

Biology, 03.02.2021 01:00

Chemistry, 03.02.2021 01:00

Biology, 03.02.2021 01:00

Mathematics, 03.02.2021 01:00

Advanced Placement (AP), 03.02.2021 01:00

Mathematics, 03.02.2021 01:00

Chemistry, 03.02.2021 01:00

Mathematics, 03.02.2021 01:00