Business, 02.03.2020 16:52 breannaratliff23

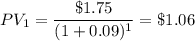

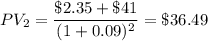

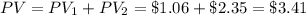

Valorous Corporation will pay a dividend of $1.75 per share at this year's end and a dividend of $2.35 per share at the end of next year. It is expected that the price of Valorous' stock will be $41 per share after two years. If Valorous has an equity cost of capital of 9%, what is the maximum price that a prudent investor would be willing to pay for a share of Valorous stock today?

Answers: 3

Another question on Business

Business, 22.06.2019 15:30

For a firm that uses the weighted average method of process costing, which of the following must be true? (a) physical units can be greater than or less than equivalent units. (b) physical units must be equal to equivalent units. (c) equivalent units must be greater than or equal to physical units. (d) physical units must be greater than or equal to equivalent units.

Answers: 1

Business, 22.06.2019 16:30

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

Business, 22.06.2019 17:30

What is the sequence of events that could lead to trade surplus

Answers: 3

You know the right answer?

Valorous Corporation will pay a dividend of $1.75 per share at this year's end and a dividend of $2....

Questions

Mathematics, 03.10.2021 14:00

Physics, 03.10.2021 14:00

Social Studies, 03.10.2021 14:00

Mathematics, 03.10.2021 14:00

Mathematics, 03.10.2021 14:00

Mathematics, 03.10.2021 14:00

Mathematics, 03.10.2021 14:00

Mathematics, 03.10.2021 14:00

Social Studies, 03.10.2021 14:00

Social Studies, 03.10.2021 14:00

Geography, 03.10.2021 14:00