Business, 06.03.2020 23:58 emojigirl2824

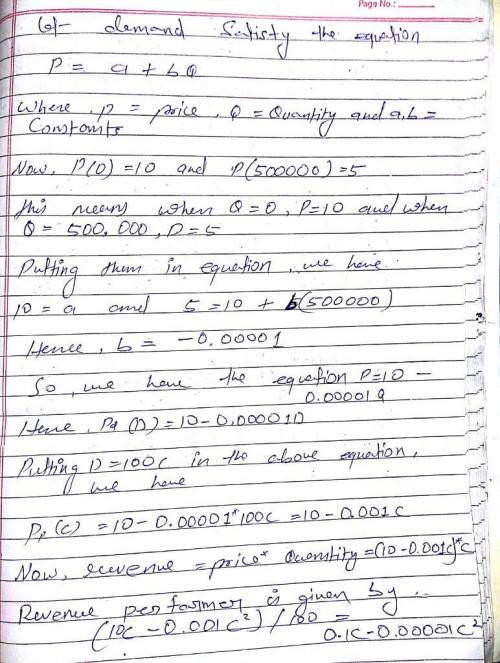

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested by every farmer depends on the weather: sunny weather yields more com than cloudy weather during the growing season. All corn is harvested simultaneously, and the price per bushel is determined by a market demand function. Suppose the price dem and function P = Pl(D) is such that Pa (0-10 dollars and Pa (500000-5 dollars, and Pi (D) is linear in D, the demand in bushels. Then (1) price in terms of demand Pd(D10-0.000010 dollars Through supply and demand equality, the demand equals the total crop size. The amounts produced on different farms are all perfectly correlated and there are a total of 100 farms, and thus D- 100C, Then (2) price in terms of production P Then from selling the crop, each farmer has (3) revenue from production Rp(C) - dollars IC- 00001C"(2) dollars This shows that the revenue is a nonlinear function of the underlying variable C. Because of the weather, C is random and each farmer faces nonlinear risk. Can a farmer hedge this risk in advance by participating in the futures market for corn? Since the farmer is ultimately going to sell his corn harvest at the (risky) spot price, it might be prudent to sell some corn now at a known price in the futures market. Indeed, if the farmer knew exactly how much con he would produce, and only the price were uncertain, he could implement an equal and opposite policy by shorting this amount in the corn futures market. Let C be the expected corn production. Let P Pp(C) be the expected price at future time T Suppose the farmer enters into h corn future contracts, where < 0 represents the sale of (-h) > 0 bushels of corn at time T for P per bushel, and h > 0 represents purchase of h bushels of corn at time T for P per bushel

Answers: 1

Another question on Business

Business, 22.06.2019 14:00

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

Business, 22.06.2019 20:50

Many potential buyers value high-quality used cars at the full-information market price of € p1 and lemons at € p2. a limited number of potential sellers value high-quality cars at € v1 ≤ p1 and lemons at € v2 ≤ p2. everyone is risk neutral. the share of lemons among all the used cars that might be potentially sold is € θ . suppose that the buyers incur a transaction cost of $200 to purchase a car. this transaction cost is the value of their time to find a car. what is the equilibrium? is it possible that no cars are sold

Answers: 2

Business, 23.06.2019 00:30

Activity-based costing (abc) is not truly a cost collection mechanism as much as it is an inventory valuation method. the main purpose for implementing an activity-based cost system is to try to overcome some of the cost distortions that occur in traditional costing from product differences when there are variations in size and complexity. however, one of the disadvantages of utilizing abc is that the additional information gathering necessary to implement costing with that level of detail might be beyond the reach of some companies with resource or financial constraints. with this in mind, what kinds of industries or companies do you think would benefit most from using activity-based costing and why? in designing or modifying an accounting system to capture appropriate costs for abc, what considerations do you think would need to be made?

Answers: 3

You know the right answer?

A certain commodity, which we call corn, is grown by many farmers, but the amount of corn harvested...

Questions

Health, 05.10.2019 05:50

Geography, 05.10.2019 05:50

Physics, 05.10.2019 05:50

Mathematics, 05.10.2019 05:50

Social Studies, 05.10.2019 05:50

Mathematics, 05.10.2019 05:50

Mathematics, 05.10.2019 05:50

English, 05.10.2019 05:50

Health, 05.10.2019 05:50

Mathematics, 05.10.2019 05:50

History, 05.10.2019 05:50