Business, 11.03.2020 03:14 alejdnn889283

As an equity analyst you are concerned with what will happen to the required return to Universal Toddler Industries stock as market conditions change. Suppose rRF=5% rM =12% and bUTI = 1.4

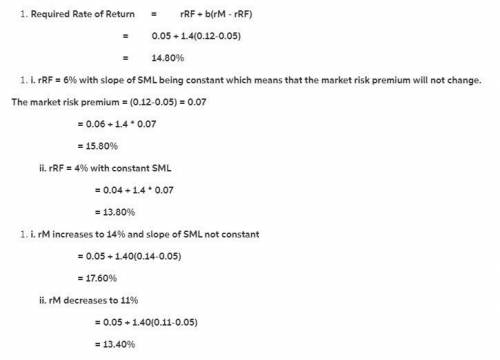

A. Under the current conditions what is rUTI, the required rate of return on UTI Stock?

B. Now suppose rFR (1) increases to 6% or (2) decreases to 4%. The slope of the SMI remains constant. How would this affect rM and rUTI?

C. Now assume rFR remains at 5% but rM (1) increases to 14% or (2) falls to 11%. The slope of the SML does not remain constant. How would these changes affect rUTI?

Answers: 3

Another question on Business

Business, 21.06.2019 14:10

What sources about ecuador should you consult to obtain cultural information about this country that will need to be included in your cultural map?

Answers: 2

Business, 21.06.2019 16:30

Which of the following is the least effective way to reach a potential sales prospect? referral cold call direct mail personal visit

Answers: 3

Business, 21.06.2019 21:20

Abakery wants to determine how many trays of doughnuts it should prepare each day. demand is normal with a mean of 5 trays and standard deviation of 1 tray. if the owner wants a service level of at least 95%, how many trays should he prepare (rounded to the nearest whole tray)? assume doughnuts have no salvage value after the day is complete.

Answers: 2

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

You know the right answer?

As an equity analyst you are concerned with what will happen to the required return to Universal Tod...

Questions

Biology, 03.04.2020 02:08

English, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

Geography, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

Chemistry, 03.04.2020 02:08

History, 03.04.2020 02:08

English, 03.04.2020 02:08

Mathematics, 03.04.2020 02:08

English, 03.04.2020 02:08

History, 03.04.2020 02:09