Business, 23.03.2020 21:32 brinleychristofferse

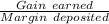

You sell short 500 shares of CF Industries Holdings Inc. that are currently selling at $25.00 per share. You post the 60.00% margin required on the short sale. If you earn no interest on the funds in your margin account, what will be your rate of return after 1 year if CF Industries Holdings Inc. is selling at $23.00

Answers: 3

Another question on Business

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 15:00

(a) what do you think will happen if the price of non-gm crops continues to rise? why? (b) what will happen if the price of non-gm food drops? why?

Answers: 2

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

Business, 22.06.2019 20:50

The following accounts are from last year’s books at s manufacturing: raw materials bal 0 (b) 157,400 (a) 172,500 15,100 work in process bal 0 (f) 523,600 (b) 133,700 (c) 171,400 (e) 218,500 0 finished goods bal 0 (g) 477,000 (f) 523,600 46,600 manufacturing overhead (b) 23,700 (e) 218,500 (c) 27,700 (d) 159,400 7,700 cost of goods sold (g) 477,000 s manufacturing uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. what is the amount of cost of goods manufactured for the year

Answers: 3

You know the right answer?

You sell short 500 shares of CF Industries Holdings Inc. that are currently selling at $25.00 per sh...

Questions

Physics, 14.09.2019 08:30

History, 14.09.2019 08:30

Mathematics, 14.09.2019 08:30

Mathematics, 14.09.2019 08:30

English, 14.09.2019 08:30

=

=  = 13.33%

= 13.33%