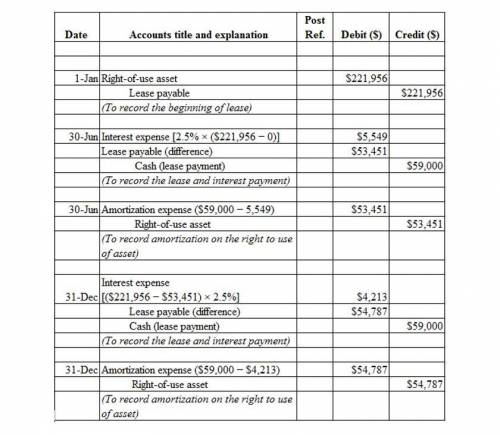

On January 1, 2018, Robertson Construction leased several items of equipment under a two-year operating lease agreement from Jamison Leasing, which routinely finances equipment for other firms at an annual interest rate of 5%. The contract calls for four rent payments of $59,000 each, payable semiannually on June 30 and December 31 each year. The equipment was acquired by Jamison Leasing at a cost of $379,000 and was expected to have a useful life of 6 years with no residual value. Both firms record amortization and depreciation semi-annually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the appropriate journal entries for the lessee from the beginning of the lease through the end of 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.)

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

You know the right answer?

On January 1, 2018, Robertson Construction leased several items of equipment under a two-year operat...

Questions

Business, 19.09.2019 04:10

Chemistry, 19.09.2019 04:10

English, 19.09.2019 04:10

English, 19.09.2019 04:10

Mathematics, 19.09.2019 04:10

English, 19.09.2019 04:10

Mathematics, 19.09.2019 04:10

History, 19.09.2019 04:10