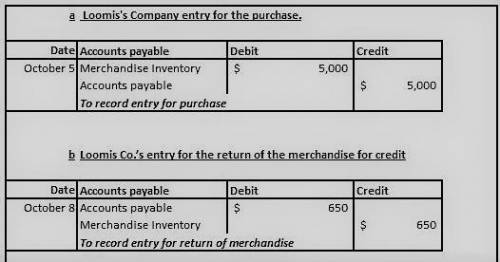

On October 5, Loomis Company buys merchandise on account from Brooke Company. The selling price of the goods is $5,000, and the cost to Brooke Company is $3,100. On October 8, Loomis returns defective goods with a selling price of $650 and a fair value of $100. Record the transactions on the books of Loomis Company.

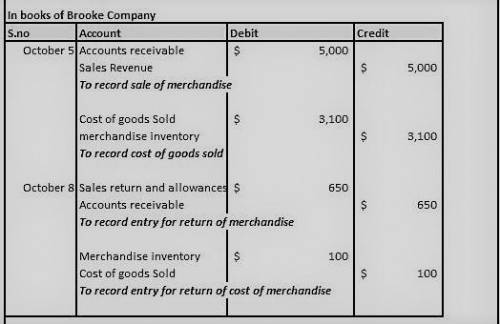

Assume information similar to that in DO IT! 5-2: On October 5, Loomis Com- pany buys merchandise on account from Brooke Company. The selling price of the goods is $5,000, and the cost to Brooke Company is $3,100. On October 8, Loomis returns defec- tive goods with a selling price of $650 and a fair value of $100. Record the transactions on the books of Brooke Company.

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

Net income and owner's equity for four businesses four different proprietorships, jupiter, mars, saturn, and venus, show the same balance sheet data at the beginning and end of a year. these data, exclusive of the amount of owner's equity, are summarized as follows: total assets total liabilities beginning of the year $550,000 $215,000 end of the year 844,000 320,000 on the basis of the preceding data and the following additional information for the year, determine the net income (or loss) of each company for the year. (hint: first determine the amount of increase or decrease in owner's equity during the year.) jupiter: the owner had made no additional investments in the business and had made no withdrawals from the business. mars: the owner had made no additional investments in the business but had withdrawn $36,000. saturn: the owner had made an additional investment of $60,000 but had made no withdrawals. venus: the owner had made an additional investment of $60,000 and had withdrawn $36,000. jupiter net income $ mars net income $ saturn net income $ venus net income $

Answers: 3

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

You know the right answer?

On October 5, Loomis Company buys merchandise on account from Brooke Company. The selling price of t...

Questions

World Languages, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50

History, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50

Mathematics, 12.11.2020 20:50