Business, 08.04.2020 22:48 smiley0326

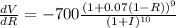

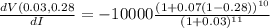

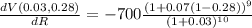

The value of an investment of $1000 earning 7% compounded annually is V(I, R) = 1000 1 + 0.07(1 − R) 1 + I 10 where I is the annual rate of inflation and R is the tax rate for the person making the investment. Calculate VI(0.03, 0.28) and VR(0.03, 0.28). (Round your answers to two decimal places.) VI(0.03, 0.28) = VR(0.03, 0.28) =

Answers: 1

Another question on Business

Business, 21.06.2019 12:30

Diener and wallbom (1976) found that when research participants were instructed to stop working on a problem after a bell sounded, 71 percent continued working when left alone. how many continued to work after the bell if they were made self-aware by working in front of a mirror?

Answers: 2

Business, 21.06.2019 21:50

Discuss how the resource-based view (rbv) of the firm combines the two perspectives of (1) an internal analysis of a firm and (2) an external analysis of its industry and its competitive environment. include comments on the different types of firm resources and how these resources can be used by a firm to build sustainable competitive advantages.

Answers: 3

Business, 21.06.2019 22:30

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

Business, 21.06.2019 23:30

Highland company produces a lightweight backpack that is popular with college students. standard variable costs relating to a single backpack are given below

Answers: 1

You know the right answer?

The value of an investment of $1000 earning 7% compounded annually is V(I, R) = 1000 1 + 0.07(1 − R)...

Questions

Mathematics, 26.04.2021 14:00

History, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

History, 26.04.2021 14:00

Law, 26.04.2021 14:00

English, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

Mathematics, 26.04.2021 14:00

![V(I,R)=1000[\frac{1+0.07(1-R)}{1+I}]^{10}](/tpl/images/0590/5206/87f0f.png)