Business, 06.05.2020 04:09 juliannabartra

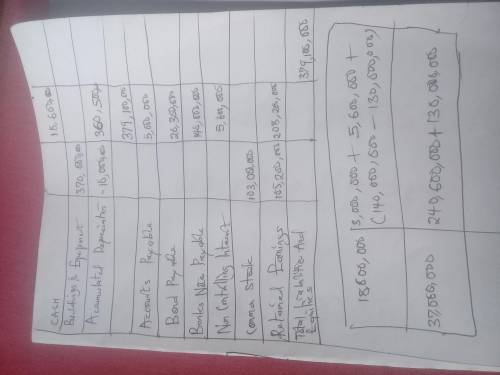

Gamble Company convinced Conservative Corporation that the two companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Corner. Although chances for the casino’s success were relatively low, a local bank loaned $140,000,000 to the new corporation, which built the casino at a cost of $130,000,000. Conservative purchased 100 percent of the initial capital stock offering for $5,600,000, and Gamble agreed to supply 100 percent of the management and guarantee the bank loan. Gamble also guaranteed a 20 percent return to Conservative on its investment for the first 10 years. Gamble will receive all profits in excess of the 20 percent return to Conservative. Immediately after the casino’s construction, Gamble reported the following amounts: Cash $ 3,000,000 Buildings and Equipment 240,600,000 Accumulated Depreciation 10,100,000 Accounts Payable 5,000,000 Bonds Payable 20,300,000 Common Stock 103,000,000 Retained Earnings 105,200,000 The only disclosure that Gamble currently provides in its financial reports about its relationships to Conservative and Simpletown is a brief footnote indicating that a contingent liability exists on its guarantee of Simpletown Corporation’s debt. Required:Prepare a consolidated balance sheet for Gamble immediately following the casino’s construction.(Amounts to be deducted should be indicated by minus sign.)

Answers: 1

Another question on Business

Business, 22.06.2019 21:30

True or false payroll withholding includes income tax, social security tax, medicare tax as well as money you deduct for your retirement fund.

Answers: 1

Business, 22.06.2019 23:30

Miller company’s total sales are $171,000. the company’s direct labor cost is $20,520, which represents 30% of its total conversion cost and 40% of its total prime cost. its total selling and administrative expense is $25,650 and its only variable selling and administrative expense is a sales commission of 5% of sales. the company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. required: 1. what is the total manufacturing overhead cost? 2. what is the total direct materials cost? 3. what is the total manufacturing cost? 4. what is the total variable selling and administrative cost? 5. what is the total variable cost? 6. what is the total fixed cost? 7. what is the total contribution margin?

Answers: 3

You know the right answer?

Gamble Company convinced Conservative Corporation that the two companies should establish Simpletown...

Questions

Biology, 21.07.2019 09:00

Biology, 21.07.2019 09:00

History, 21.07.2019 09:00

History, 21.07.2019 09:00

Biology, 21.07.2019 09:00

Biology, 21.07.2019 09:00

Mathematics, 21.07.2019 09:00

History, 21.07.2019 09:00

Chemistry, 21.07.2019 09:00

Chemistry, 21.07.2019 09:00