Hedged Purchase Commitment and Exposed Liability Position, with Adjusting Entries

On November...

Business, 10.05.2020 07:57 beckytank6338

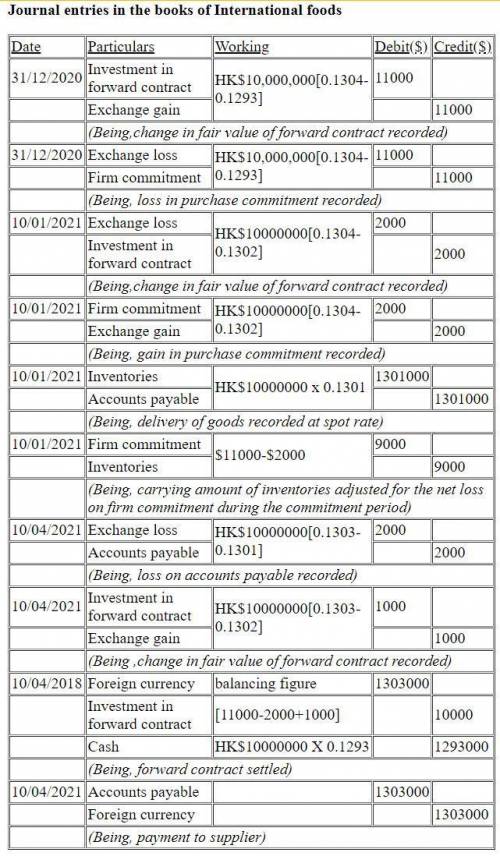

Hedged Purchase Commitment and Exposed Liability Position, with Adjusting Entries

On November 20, 2020, International Foods, a U. S. company, agreed to purchase merchandise from a Hong Kong supplier at a price of HK$10,000,000. The merchandise will be delivered on January 10, 2021, and the amount owing is payable on April 10, 2021, in Hong Kong dollars. To hedge the expected future payment, International entered a forward contract for purchase of HK$10,000,000 on April 10, 2021. On January 10, 2021, the merchandise was delivered as promised. On April 10, International closed the forward contract and used the Hong Kong dollars to pay its supplier. International accounting year ends December 31. Exchange rates ($/HK$) are as follows:

Spot rate Forward rate for delivery April 10, 2021

November 20, 2020 $0.1289 $0.1293

December 31,2020 0.1299 0.1304

January 10,2021 0.1301 0.1302

April 10,2021 0.1303

Prepare the journal entries International Foods made on January 10,2021 and April 10.2021 to record the above transactions, as well as its end-of-year adjusting entries on December 31, 2020.

Answers: 3

Another question on Business

Business, 21.06.2019 16:30

Collective bargaining provides for a representative of employees to negotiate with a representative of management over labor issues including wages.true or false?

Answers: 3

Business, 22.06.2019 02:20

Archangel manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. the production details for the year are given below. calculate the manufacturing overhead allocation rate for the year based on the above data. (round your final answer to two decimal places.) a) 42.42% b) 257.14% c) 235.71% d) 1, 206.90% archangel production details.

Answers: 3

Business, 22.06.2019 21:00

On july 2, year 4, wynn, inc., purchased as a short-term investment a $1 million face-value kean co. 8% bond for $910,000 plus accrued interest to yield 10%. the bonds mature on january 1, year 11, and pay interest annually on january 1. on december 31, year 4, the bonds had a fair value of $945,000. on february 13, year 5, wynn sold the bonds for $920,000. in its december 31, year 4, balance sheet, what amount should wynn report for the bond if it is classified as an available-for-sale security?

Answers: 3

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

You know the right answer?

Questions

Mathematics, 05.07.2021 14:20

English, 05.07.2021 14:20

Biology, 05.07.2021 14:20

Social Studies, 05.07.2021 14:20

History, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Chemistry, 05.07.2021 14:20

English, 05.07.2021 14:20

History, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Mathematics, 05.07.2021 14:20

Computers and Technology, 05.07.2021 14:20