Answers: 1

Another question on Business

Business, 22.06.2019 19:20

After jeff bezos read about how the internet was growing by 2,000 percent a month, he set out to use the internet as a new distribution channel and founded amazon, which is now the world's largest online retailer. this is clearly an example of a(n)a. firm that uses closed innovation. b. entrepreneur who commercialized invention into an innovation. c. business that entered the industry during its maturity stage. d. exception to the long tail business model

Answers: 1

Business, 22.06.2019 19:40

Chang corp. has $375,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $595,000, and its net income was $25,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. what profit margin would the firm need in order to achieve the 15% roe, holding everything else constant? a. 9.45%b. 9.93%c. 10.42%d. 10.94%e. 11.49%

Answers: 2

Business, 22.06.2019 22:30

Suppose that each country completely specializes in the production of the good in which it has a comparative advantage, producing only that good. in this case, the country that produces jeans will produce million pairs per week, and the country that produces corn will produce million bushels per week.

Answers: 1

Business, 23.06.2019 00:00

Todd and jim learned that in building a business plan, it was important for them to:

Answers: 1

You know the right answer?

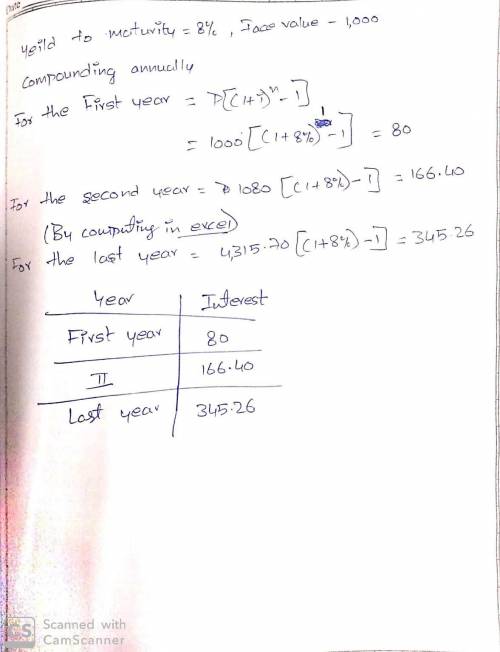

A newly issued 20-year maturity, zero-coupon bond making annual coupon payments is issued with a yie...

Questions

Mathematics, 10.02.2021 04:20

Computers and Technology, 10.02.2021 04:20

English, 10.02.2021 04:20

History, 10.02.2021 04:20

Mathematics, 10.02.2021 04:20

Mathematics, 10.02.2021 04:20

Mathematics, 10.02.2021 04:20

Mathematics, 10.02.2021 04:20

Mathematics, 10.02.2021 04:20

English, 10.02.2021 04:20