Answers: 3

Another question on Business

Business, 22.06.2019 10:20

The different concepts in the architecture operating model are aligned with how the business chooses to integrate and standardize with an enterprise solution. in the the technology solution shares data across the enterprise.

Answers: 3

Business, 22.06.2019 12:10

The following transactions occur for badger biking company during the month of june: a. provide services to customers on account for $32,000. b. receive cash of $24,000 from customers in (a) above. c. purchase bike equipment by signing a note with the bank for $17,000. d. pay utilities of $3,200 for the current month. analyze each transaction and indicate the amount of increases and decreases in the accounting equation. (decreases to account classifications should be entered as a negative.)

Answers: 1

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 22.06.2019 22:30

Aresearcher developing scanners to search for hidden weapons at airports has concluded that a new scanner isis significantly better than the current scanner. he made his decision based on a test using alpha equals 0.025 .α=0.025. would he have made the same decision at alpha equals 0.10 question mark α=0.10? how about alpha equals 0.01 question mark α=0.01? explain

Answers: 3

You know the right answer?

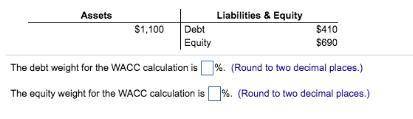

Andyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.4. Assuming th...

Questions

Mathematics, 25.04.2020 01:07

English, 25.04.2020 01:07

Social Studies, 25.04.2020 01:07

Mathematics, 25.04.2020 01:07

Mathematics, 25.04.2020 01:07

Mathematics, 25.04.2020 01:07