Business, 25.07.2020 01:01 christopherluckey7

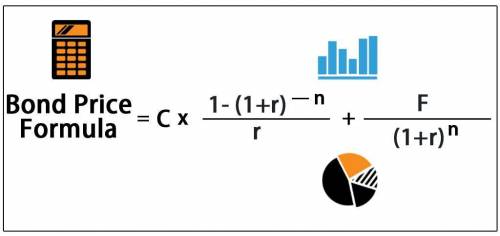

Gabriele Enterprises has bonds on the market making annual payments, with eight years to maturity, a par value of $1,000, and selling for $948. At this price, the bonds yield 5.1 percent. What must the coupon rate be on the bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

3. describe the purpose of the sec. (1-4 sentences. 2.0 points)

Answers: 3

Business, 22.06.2019 21:00

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion, (2) investment = $40 billion, (3) government purchases = $90 billion, and (4) net export = $25 billion. if the full-employment level of gdp for this economy is $600 billion, then what combination of actions would be most consistent with closing the gdp gap here?

Answers: 3

Business, 23.06.2019 00:10

Kcompany estimates that overhead costs for the next year will be $4,900,000 for indirect labor and $1,000,000 for factory utilities. the company uses direct labor hours as its overhead allocation base. if 100,000 direct labor hours are planned for this next year, what is the company's plantwide overhead rate?

Answers: 3

Business, 23.06.2019 00:30

What level of measurement (nominal, ordinal, interval, ratio) is appropriate for the movie rating system that you see in tv guide?

Answers: 2

You know the right answer?

Gabriele Enterprises has bonds on the market making annual payments, with eight years to maturity, a...

Questions

Social Studies, 29.07.2019 11:30

Mathematics, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Business, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Business, 29.07.2019 11:30

Biology, 29.07.2019 11:30

Social Studies, 29.07.2019 11:30

History, 29.07.2019 11:30