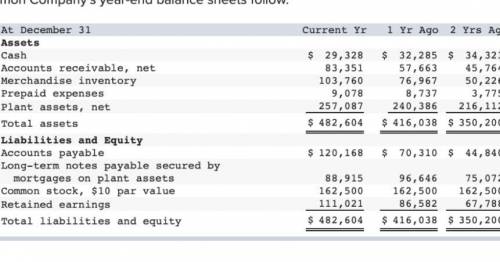

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 29,328 83,351 103,760 9,078 257,087 $ 482,604 $ 32,285 $ 34, 323 57,663 45,764 76,967 50, 226 8,737 3,775 240,386 216,112 $ 416,038 $ 350, 200 $ 120,168 $ 70,310 $ 44,840 88,915 162,500 111,021 $ 482,604 96,646 75,072 162,500 162,500 86,582 67, 788 $ 416,038 $ 350, 200 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period?

Answers: 2

Another question on Business

Business, 22.06.2019 06:40

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 17:30

According to management education expert ashok rao, companies can increase their profitability by through careful inventory management. a. 5% to 10% b. 10% to 25% c. 20% to 50% d. 75%

Answers: 1

Business, 23.06.2019 01:10

1. alwaysrain irrigation, inc. would like to determine capacity requirements for the next four years. currently, two production lines are in place for making bronze and plastic sprinklers. three types of sprinklers are available in both bronze and plastic: 90-degree nozzle sprinklers, 180-degree nozzle sprinklers, and 360-degree nozzle sprinklers. management has forecast demand for the next four years as follows: both production lines can produce all the different types of nozzles. the bronze machines needed for the bronze sprinklers require two operators and can produce up to 12,000 sprinklers. the plastic injection molding machine needed for the plastic sprinklers requires four operators and can produce up to 200,000 sprinklers. three bronze machines and only one injection molding machine are available. what are the capacity requirements for the next four years? (assume that there is no learning.)

Answers: 1

You know the right answer?

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets...

Questions

Mathematics, 05.07.2020 14:01

Mathematics, 05.07.2020 14:01

Computers and Technology, 05.07.2020 14:01