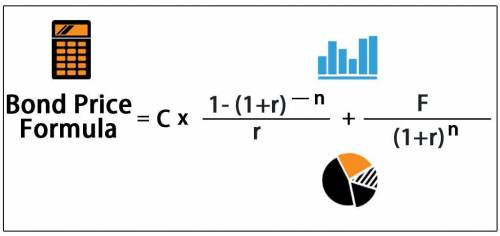

On January 1, 2015, East Lansing, Inc, issues $2,000,000 of 10 percent, 5-year bonds that pay interest of $100,000 semiannually. The market rate is 8 percent at the time of issuance. The issue price of the bonds is:a. $1,852.810 b. $1888,970 c. $1.999.970 d. $2,162.290

Answers: 3

Another question on Business

Business, 21.06.2019 12:30

Trinity trucking signs a contract with olsen oil to purchase all of the fuel for its fleet of trucks for the next year from olsen at a price of $3.00 per gallon. at the time trinity and olsen sign the contract, the market price for gasoline was $3.25 per gallon, and trinity had an expert report predicting that the price would rise to at least $4.25 per gallon in the upcoming six months. instead, the price dropped to $2.00 per gallon. may trinity rescind the contract with olsen due to its mistaken belief about the future of the price of gasoline?

Answers: 2

Business, 22.06.2019 00:20

Suppose that the world price of steel is $100 a ton, india does not trade internationally, and the equilibrium price of steel in india is $60 a ton. suppose that india now begins to trade internationally. the price of steel in india the quantity of steel produced in india a. does not change; does not change b. falls; increases c. falls; decreases d. rises; decreases e. rises; increases the quantity of steel bought by india india steel. a. increases; exports b. decreases; imports c. decreases; exports d. does not change; neither imports nor exports e. increases; imports

Answers: 2

Business, 22.06.2019 11:10

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

Business, 22.06.2019 12:10

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a.no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative.b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child.c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative.d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

You know the right answer?

On January 1, 2015, East Lansing, Inc, issues $2,000,000 of 10 percent, 5-year bonds that pay intere...

Questions

Mathematics, 01.12.2020 17:00

Mathematics, 01.12.2020 17:00

Biology, 01.12.2020 17:00

Social Studies, 01.12.2020 17:00

Health, 01.12.2020 17:00