Business, 20.09.2020 15:01 tejalawatson91

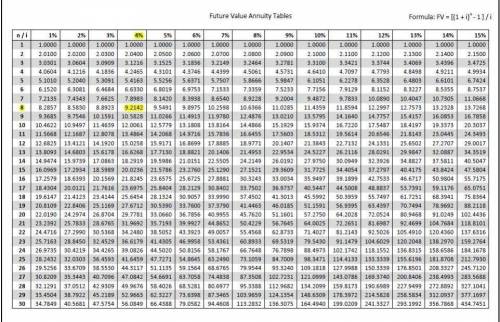

The Great Giant Corp. has a management contract with its newly hired president. The contract requires a lump sum payment of $25,300,000 be paid to the president upon the completion of her first 6 years of service. The company wants to set aside an equal amount of funds each year to cover this anticipated cash outflow. The company can earn 5 percent on these funds. How much must the company set aside each year for this purpose

Answers: 2

Another question on Business

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 22:00

Acompany's sales in year 1 were $300,000, year 2 were $351,000, and year 3 were $400,000. using year 2 as a base year, the sales percent for year 3 is

Answers: 2

Business, 22.06.2019 22:50

Awork system has five stations that have process times of 5, 9, 4, 9, and 8. what is the throughput time of the system? a. 7b. 4c. 18d. 35e. 9

Answers: 2

Business, 23.06.2019 01:00

Lycan, inc., has 7.5 percent coupon bonds on the market that have 8 years left to maturity. the bonds make annual payments and have a par value of $1,000. if the ytm on these bonds is 9.5 percent, what is the current bond price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) current bond price

Answers: 2

You know the right answer?

The Great Giant Corp. has a management contract with its newly hired president. The contract require...

Questions

Mathematics, 25.06.2020 06:01

Health, 25.06.2020 06:01

Mathematics, 25.06.2020 06:01

Mathematics, 25.06.2020 06:01

Mathematics, 25.06.2020 06:01

Mathematics, 25.06.2020 06:01