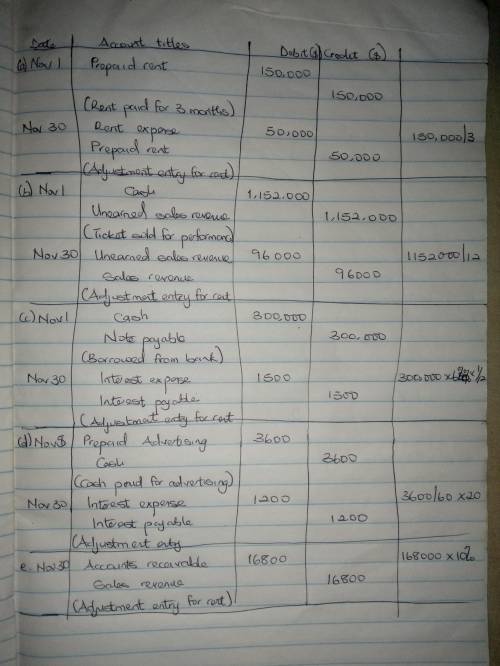

The following ledger accounts are used by the Heartland Race Track:. Accounts Receivable Prepaid Advertising Prepaid Rent Unearned Sales Revenue Sales Revenue Advertising Expense Rent Expense

For each of the following transactions below, prepare the journal entry (if one is required) to record the initial transaction and then prepare the adjusting entry, if any, required on November 30, the end of the fiscal year.

(a) On November 1, paid rent on the track facility for three months, $180,000.

(b) On November 1, sold season tickets for admission to the racetrack. The racing season is year-round with 25 racing days each month. Season ticket sales totaled $1,152,000.

(c) On November 1, borrowed $300,000 from First National Bank by issuing a 6% note payable due in three months.

(d) On November 5, programs for 20 racing days in November, 25 racing days in December and 15 racing days in January were printed for $3,600.

(e) The accountant for the concessions company reported that gross receipts for November were $168,000. 10 percent is due to Heartland and will be remitted by December 10.

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

Which of the following statements about the relationship between economic costs and accounting costs is true? multiple choice accounting costs are equal to or greater than economic costs. accounting costs must always equal economic costs. accounting costs are always greater than economic costs. accounting costs are always less than or equal to economic costs.

Answers: 2

Business, 22.06.2019 00:10

Which of the following is a problem for the production of public goods?

Answers: 2

Business, 22.06.2019 02:50

Grey company holds an overdue note receivable of $800,000 plus recorded accrued interest of $64,000. the effective interest rate is 8%. as the result of a court-imposed settlement on december 31, year 3, grey agreed to the following restructuring arrangement: reduced the principal obligation to $600,000.forgave the $64,000 accrued interest.extended the maturity date to december 31, year 5.annual interest of $40,000 is to be paid to grey on december 31, year 4 and year 5. the present value of the interest and principal payments to be received by grey company discounted for two years at 8% is $585,734. grey does not elect the fair value option for reporting the debt modification. on december 31, year 3, grey would recognize a valuation allowance for impaired loans of

Answers: 3

Business, 22.06.2019 14:40

Which of the following statements about revision is most accurate? (a) you must compose first drafts quickly (sprint writing) and return later for editing. (b) careful writers always revise as they write. (c) revision is required for only long and complex business documents. (d) some business writers prefer to compose first drafts quickly and revise later; others prefer to revise as they go.

Answers: 3

You know the right answer?

The following ledger accounts are used by the Heartland Race Track:. Accounts Receivable Prepaid Adv...

Questions

Arts, 29.04.2021 16:40

Biology, 29.04.2021 16:40

Mathematics, 29.04.2021 16:40

History, 29.04.2021 16:40

History, 29.04.2021 16:40

Mathematics, 29.04.2021 16:40

Computers and Technology, 29.04.2021 16:40

Mathematics, 29.04.2021 16:40

Arts, 29.04.2021 16:40

Mathematics, 29.04.2021 16:40

Chemistry, 29.04.2021 16:40

Mathematics, 29.04.2021 16:40