Business, 20.10.2020 21:01 curlyysav536

The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system.

April 30 May 31

Inventories

Raw materials $ 42,000 $ 44,000

Work in process 9,400 18,400

Finished goods 59,000 33,200

Activities and information for May

Raw materials purchases (paid with cash) 191,000

Factory payroll (paid with cash) 200,000

Factory overhead

Indirect materials 17,000

Indirect labor 46,000

Other overhead costs 91,000

Sales (received in cash) 1,900,000

Predetermined overhead rate based on direct labor cost 55 %

Compute the following amounts for the month of May using T-accounts.

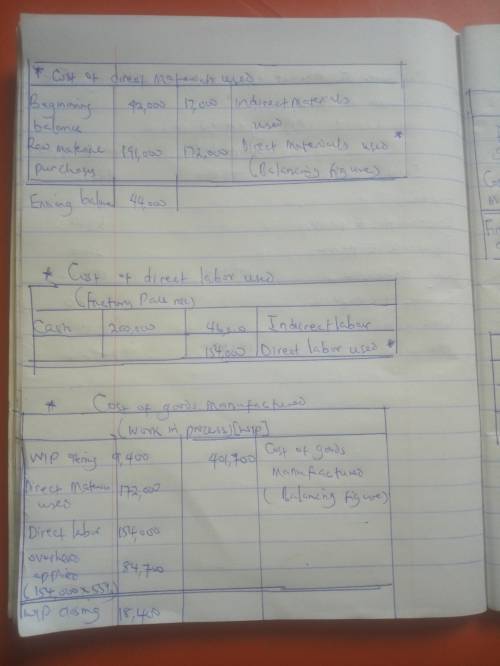

Cost of direct materials used.

Cost of direct labor used.

Cost of goods manufactured.

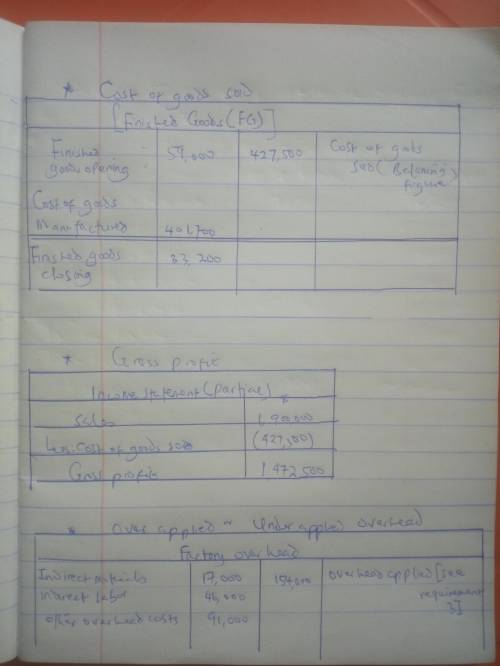

Cost of goods sold.*

Gross profit.

Overapplied or underapplied overhead.

*Do not consider any underapplied or overapplied overhead.

Raw Materials (RM) Work in Process (WIP)

Beginning Balance 42,000 17,000 Indirect materials Beginning Balance 9,400 Cost of goods manuf.

RM purchases 191,000 172,000 DM used DM used 172,000

DL used 154,000

Overhead applied

Ending balance 44,000 Ending balance 335,400

Finished Goods (FG) Factory Overhead

Beginning Balance 59,000 Indirect materials Overhead applied

Cost of goods manuf. Indirect labor

Other overhead costs

Ending balance 59,000

Underapplied OH

Income statement (partial)

Sales

Cost of goods sold

Gross profit

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

Unrecorded depreciation on the trucks at the end of the year is $40,000. the total amount of accrued interest expense at year-end is $6,000. the cost of unused office supplies still available at year-end is $2,000. 1. use the above information about the company’s adjustments to complete a 10-column work sheet. 2a. prepare the year-end closing entries for dylan delivery company as of december 31, 2017. 2b. determine the capital amount to be reported on the december 31, 2017 balance sheet.

Answers: 1

Business, 22.06.2019 03:30

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

You know the right answer?

The following information is available for Lock-Tite Company, which produces special-order security...

Questions

Computers and Technology, 07.11.2019 02:31