Business, 02.11.2020 16:40 lizchavarria863

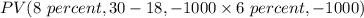

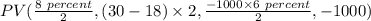

Eighteen years ago a firm issued $1000 par value bonds with a 6% annual coupon rate and a term to maturity of 30 years. Market interest rates have increased since then and par value bonds today would carry an annual coupon rate of 8% (current yield to maturity). What would these bonds sell for today if they made annual coupon payments

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

Performance bicycle company makes steel and titanium handle bars for bicycles. it requires approximately 1 hour of labor to make one handle bar of either type. during the most recent accounting period, barr company made 7,700 steel bars and 2,300 titanium bars. setup costs amounted to $35,000. one batch of each type of bar was run each month. if a single company-wide overhead rate based on direct labor hours is used to allocate overhead costs to the two products, the amount of setup cost assigned to the steel bars will be:

Answers: 2

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

Business, 22.06.2019 19:50

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

Business, 22.06.2019 20:10

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

Eighteen years ago a firm issued $1000 par value bonds with a 6% annual coupon rate and a term to ma...

Questions

Chemistry, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Biology, 18.11.2020 18:30

Physics, 18.11.2020 18:30

Biology, 18.11.2020 18:30

SAT, 18.11.2020 18:30

Mathematics, 18.11.2020 18:30

Physics, 18.11.2020 18:30

($)

($)

($)

($)