Business, 02.12.2020 01:30 algahimnada

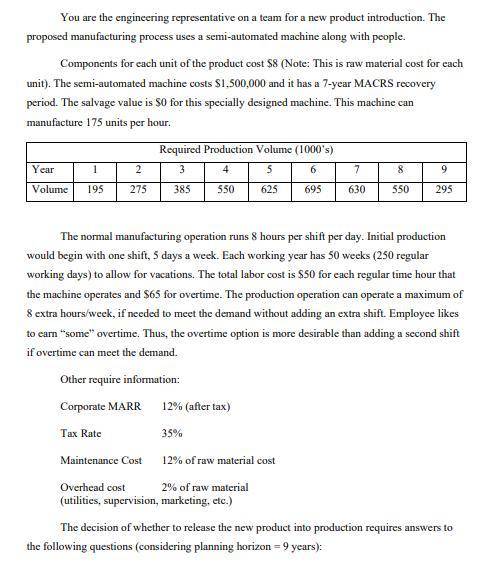

If variability of selling price per unit (consider current selling price is $10.50 per unit)

may range from -15% to +15% (i. e. selling price per unit cannot decrease by less than

15% of the current selling price and cannot increase by more that 15% of the current

selling price) and variability of raw material cost per unit (consider raw material cost per

unit as $8) may range from -15% to +15%, find After-Tax Net Present Value (ATNPV)

ATMARR 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25%

ATNPV

Raw Material Cost/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12

ATNPV

Selling Price/Unit 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 11.5 12

ATNPV

for simultaneous change in selling price and raw material cost to fill the table below

(consider After-Tax MARR is 12%):

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Monetary policy in the united states is carried out primarily by which of the following agencies? a. the department of the treasury b. the small business association c. the federal reserve bank d. the u.s. mint 2b2t

Answers: 1

Business, 22.06.2019 11:30

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

Business, 22.06.2019 21:10

The blumer company entered into the following transactions during 2012: 1. the company was started with $22,000 of common stock issued to investors for cash. 2. on july 1, the company purchased land that cost $15,500 cash. 3. there were $700 of supplies purchased on account. 4. sales on account amounted to $9,500. 5. cash collections of receivables were $5,500. 6. on october 1, 2012, the company paid $3,600 in advance for a 12-month insurance policy that became effective on october 1. 7. supplies on hand as of december 31, 2010 amounted to $225. the amount of cash flow from investing activities would be:

Answers: 2

You know the right answer?

If variability of selling price per unit (consider current selling price is $10.50 per unit)

may ra...

Questions

Mathematics, 02.07.2019 04:10

Mathematics, 02.07.2019 04:10

English, 02.07.2019 04:10

Mathematics, 02.07.2019 04:10

History, 02.07.2019 04:10