Business, 18.04.2021 06:20 Marley3082

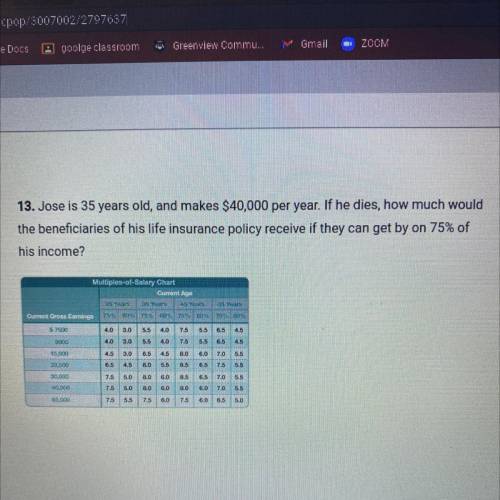

13. Jose is 35 years old, and makes $40,000 per year. If he dies, how much would

the beneficiaries of his life insurance policy receive if they can get by on 75% of

his income?

7.5

Multiples-of-Salary Chart

Current Aga

25 Yan Yasin YEN

Y

Current Gross Earnings 799 755 00475400

$ 7500

4.0 3.0 5.5 4.0

5.5 8.5 4.5

0000

4.0 3.0 5.5 4.0 7.5 5.5 6.5 4.5

.

15,000

4.5 3.0 6.5 4.5 8.0 6.0 7.0 6.5

23,600

6.5 4.5 8.0 5.5 8.5 6.5 745 5.5

30.000

7.5 5.0 8.0 6.0 8.5 6.5 7.0 5.5

40,000

7.5 5.0 8.0 6.0 8.0 6.0 7.0 5.5

85.000

7.5 5.5 7.5 6.0 7.5 6.0 6.5 5.0

Answers: 2

Another question on Business

Business, 22.06.2019 02:00

Alandowner and his neighbor purchased adjoining undeveloped lots. after both built homes on their respective lots, the landowner suggested to the neighbor that a common driveway be built where the two lots joined. the neighbor agreed. the landowner and the neighbor split the cost of constructing the driveway and entered into a written agreement to equally share the costs of its upkeep and maintenance. the agreement was recorded in the county recorder's office. two years later, the neighbor built a new driveway located entirely on his lot. the common driveway, which the landowner continued to use but which the neighbor no longer used, began to deteriorate. the landowner asked the neighbor for money to maintain the common driveway, but the neighbor refused to contribute. three years later, the neighbor conveyed his lot to a friend. the friend entered into possession and used only the driveway built by the neighbor. by this time, the common driveway had deteriorated badly and contained numerous potholes. the landowner asked the friend to pay half of what it would take to repair the common driveway. the friend refused. the landowner repaired the driveway and sued the friend for 50% of the cost of repairs. will the landowner prevail?

Answers: 2

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 13:30

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

You know the right answer?

13. Jose is 35 years old, and makes $40,000 per year. If he dies, how much would

the beneficiaries...

Questions

Social Studies, 03.08.2019 21:20

Biology, 03.08.2019 21:20

Chemistry, 03.08.2019 21:20

History, 03.08.2019 21:20

Social Studies, 03.08.2019 21:20

Biology, 03.08.2019 21:20

History, 03.08.2019 21:20

Biology, 03.08.2019 21:20

Social Studies, 03.08.2019 21:20

Computers and Technology, 03.08.2019 21:20

Mathematics, 03.08.2019 21:20

Physics, 03.08.2019 21:20

History, 03.08.2019 21:20