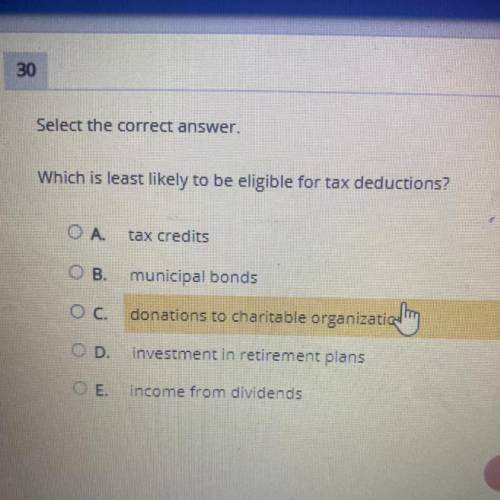

Which is least likely to be eligible for tax deductions?

OA.

tax credits

B.

munic...

Business, 01.07.2021 01:40 donniemoore

Which is least likely to be eligible for tax deductions?

OA.

tax credits

B.

municipal bonds

donations to charitable organizatial

ОС.

OD

investment in retirement plans

E.

income from dividends

Reset

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 17:10

Calculate riverside’s financial ratios for 2014. assume that riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (hint: use the book discussion to identify the applicable ratios.)

Answers: 3

Business, 22.06.2019 20:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 1

You know the right answer?

Questions

Spanish, 23.10.2019 05:20

History, 23.10.2019 05:20

Mathematics, 23.10.2019 05:20

Mathematics, 23.10.2019 05:20

History, 23.10.2019 05:20

World Languages, 23.10.2019 05:20

English, 23.10.2019 05:20

Biology, 23.10.2019 05:20

English, 23.10.2019 05:20

Biology, 23.10.2019 05:20

Mathematics, 23.10.2019 05:20

Biology, 23.10.2019 05:20

Spanish, 23.10.2019 05:20