Business, 22.08.2021 07:10 henrylauren2006

I Am so lost and am in the middle of a pretest, please help. Thank you so much.

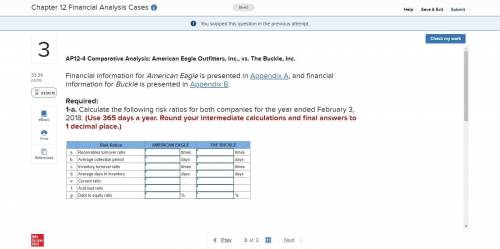

AP12-4 Comparative Analysis: American Eagle Outfitters, Inc., vs. The Buckle, Inc.

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix B.

Required:

1-a. Calculate the following risk ratios for both companies for the year ended February 3, 2018. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.)

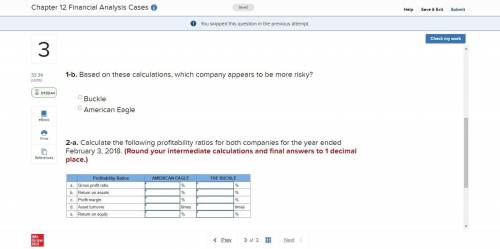

1-b. Based on these calculations, which company appears to be more risky?

Buckle

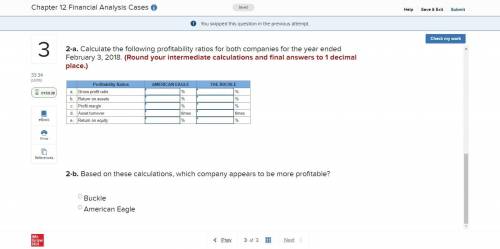

2-a. Calculate the following profitability ratios for both companies for the year ended February 3, 2018. (Round your intermediate calculations and final answers to 1 decimal place.)

2-b. Based on these calculations, which company appears to be more profitable?

APPENDIX A

https://eztocfmedia. mheducation. com/Media/Connect_Production/bne/ac counting/spiceland_fin5e/spiceland_ fin5e_app_a. pdf

APPENDIX B

https://eztocfmedia. mheducation. com/Media/Connect_Production/bne/ac counting/spiceland_fin5e/spiceland_ fin5e_app_b. pdf

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Balance sheet the assets of dallas & associates consist entirely of current assets and net plant and equipment. the firm has total assets of $2 5 million and net plant and equipment equals $2 million. it has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1 5 million. the firm does have accounts payable and accruals on its balance sheet. the firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. a. what is the company's total debt? b. what is the amount of total liabilities and equity that appears on the firm's balance sheet? c. what is the balance of current assets on the firm's balance sheet? d. what is the balance of current liabilities on the firm's balance sheet? e. what is the amount of accounts payable and accruals on its balance sheet? [hint: consider this as a single line item on the firm's balance sheet.] f. what is the firm's net working capital? g. what is the firm's net operating working capital? h. what is the explanation for the difference in your answers to parts f and g?

Answers: 1

Business, 21.06.2019 21:30

Part i a company's cereal is not selling well. create a 10-15-question survey that measures customers' preferences for the company's cereal product. then, answer the following questions: how many scale items will you put in the survey? justify your answer. will you use multiple-choice questions? why or why not? how many scale points will you use in the survey? justify your answer. what data type will be used in the survey? justify your answer. part ii as a second part of this assignment, create a set of survey questions, assuming that you sell cars. you are attempting to measure how customers perceive the quality of the cars that you sell. create three survey questions with simple category scales. justify why you selected those questions and scales. create three survey questions with multiple-choice, single-response scales. justify why you selected those questions and scales. create three survey questions with multiple-choice, multiple-response scales. justify why you selected those questions and scales. create three survey questions with likert scale summated ratings. justify why you selected those questions and scales.

Answers: 1

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 22.06.2019 20:30

When many scrum teams are working on the same product, should all of their increments be integrated every sprint?

Answers: 3

You know the right answer?

I Am so lost and am in the middle of a pretest, please help. Thank you so much.

AP12-4 Comparative...

Questions

Mathematics, 31.03.2020 23:00

Mathematics, 31.03.2020 23:00

English, 31.03.2020 23:00

Mathematics, 31.03.2020 23:00

Chemistry, 31.03.2020 23:00

Mathematics, 31.03.2020 23:00

Physics, 31.03.2020 23:00

Business, 31.03.2020 23:00

Geography, 31.03.2020 23:01

Mathematics, 31.03.2020 23:01

Mathematics, 31.03.2020 23:01

History, 31.03.2020 23:01