Mathematics, 27.09.2019 03:00 Ericapab

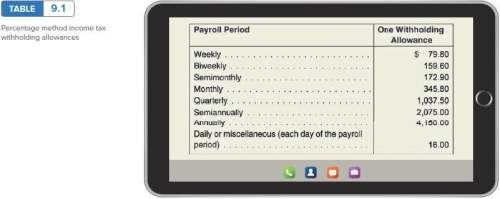

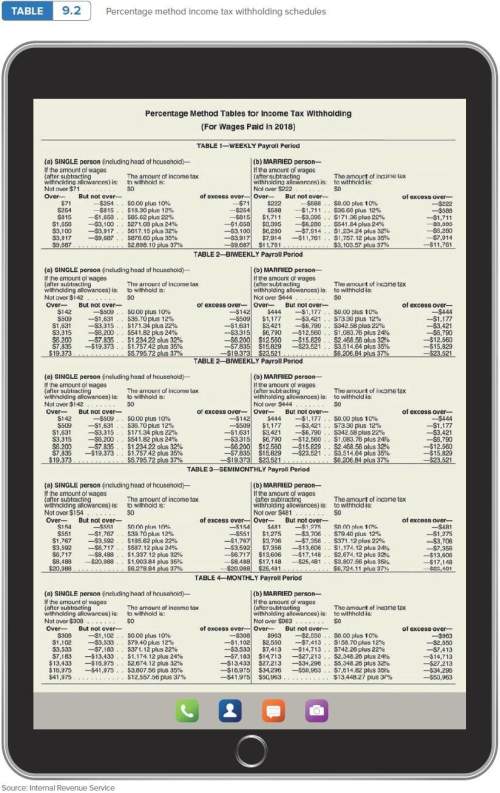

Calculate social security taxes, medicare taxes, and fit for jordon barrett. he earns a monthly salary of $13,400. he is single and claims 1 deduction. before this payroll, barrett’s cumulative earnings were $128,120. (social security maximum is 6.2% on $128,400 and medicare is 1.45%.) calculate fit by the percentage method.

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:04

Anabel uses 10 gallons of gas to drive 220 miles on the highway. if she travels at the same rate, how many miles can she drive on 7 gallons of gas

Answers: 1

Mathematics, 21.06.2019 20:30

Erin bought christmas cards for $2 each to send to her family and friends. which variable is the dependent variable?

Answers: 1

Mathematics, 21.06.2019 20:50

These tables represent a quadratic function with a vertex at (0, -1). what is the average rate of change for the interval from x = 9 to x = 10?

Answers: 2

Mathematics, 21.06.2019 21:00

Oliver read for 450 minutes this month his goal was to read for 10% more minutes next month if all of her medicine go how many minutes will you read all during the next two months

Answers: 3

You know the right answer?

Calculate social security taxes, medicare taxes, and fit for jordon barrett. he earns a monthly sala...

Questions

Mathematics, 30.07.2019 06:00

Biology, 30.07.2019 06:00

Mathematics, 30.07.2019 06:00

Mathematics, 30.07.2019 06:00

Mathematics, 30.07.2019 06:00