Assignment

active

determining the final cost of an item

the tax rate as a percent,...

Mathematics, 20.10.2019 02:10 asndjsd9397

Assignment

active

determining the final cost of an item

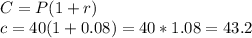

the tax rate as a percent, r, charged on an item can be determined using the formula - 1 =

r, where c is the final cost of the item and p is the price of the item before tax. louise rewrites

the equation to solve for the final cost of the item: c = p(1 + r). what is the final cost of a $40

item after an 8% tax is applied?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

An ulcer medication has 300 milligrams in 2 tablets. how many milligrams are in 3 tablets?

Answers: 1

Mathematics, 21.06.2019 21:00

Rewrite the following quadratic functions in intercept or factored form. show your work. f(t) = 20t^2 + 14t - 12

Answers: 1

Mathematics, 22.06.2019 00:10

A, at (-2, 4), is 6 .of a'? (-8, 4) (-8, -2) (-2, -2) (-2, 4) b, at (-4, -7), isy-.of b'? (-4, 7) (4, -7) (4, 7) (-4, -7)

Answers: 2

You know the right answer?

Questions

Mathematics, 20.02.2020 19:13

Computers and Technology, 20.02.2020 19:14

History, 20.02.2020 19:14

Computers and Technology, 20.02.2020 19:14