Mathematics, 02.04.2020 01:11 egirl7838

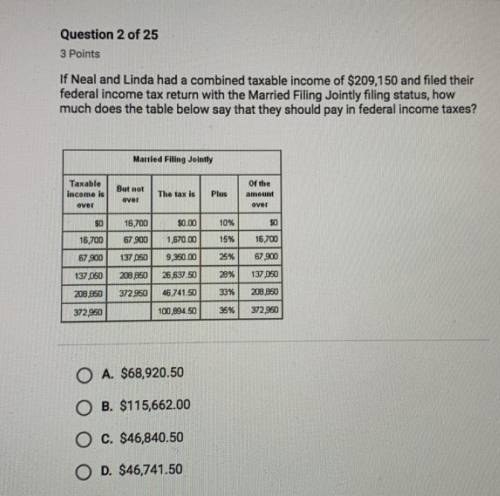

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax return with the married filing jointly filing status, how much does the table below say that they should pay in federal income taxes?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 20:00

The total number of dental clinics total for the last 12 months was recorded

Answers: 3

Mathematics, 21.06.2019 21:00

Rewrite the following quadratic functions in intercept or factored form. show your work. y = 9 + 12x + 4x^2

Answers: 2

Mathematics, 21.06.2019 21:10

The vertices of a triangle are a(7.5), b(4,2), and c19. 2). what is

Answers: 1

You know the right answer?

If Neal and Linda had a combined taxable income of $209,150 and filed their federal income tax retur...

Questions

Mathematics, 18.07.2020 21:01

Physics, 18.07.2020 21:01

Computers and Technology, 18.07.2020 21:01

Mathematics, 18.07.2020 21:01

Mathematics, 18.07.2020 21:01