Mathematics, 05.09.2020 19:01 F00Dislife

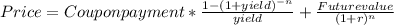

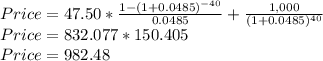

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

#1-20 state whether the angles are alternate interior, alternate exterior, vertical, or corresponding angles.

Answers: 2

Mathematics, 21.06.2019 19:30

If you can solve all of these i will give ! - 4% of 190 - 4% of 162.5 - 4% of 140 - a 4% increase from 155.1 - a 4% increase from 159.8

Answers: 2

Mathematics, 21.06.2019 23:30

Walking at a constant rate of 8 kilometers per hour, juan can cross a bridge in 6 minutes. what is the length of the bridge in meters?

Answers: 1

You know the right answer?

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon...

Questions

Mathematics, 27.02.2020 03:18

Mathematics, 27.02.2020 03:18

Medicine, 27.02.2020 03:18

Mathematics, 27.02.2020 03:18

Biology, 27.02.2020 03:18

Computers and Technology, 27.02.2020 03:18

Physics, 27.02.2020 03:18