Mathematics, 06.10.2020 23:01 j015

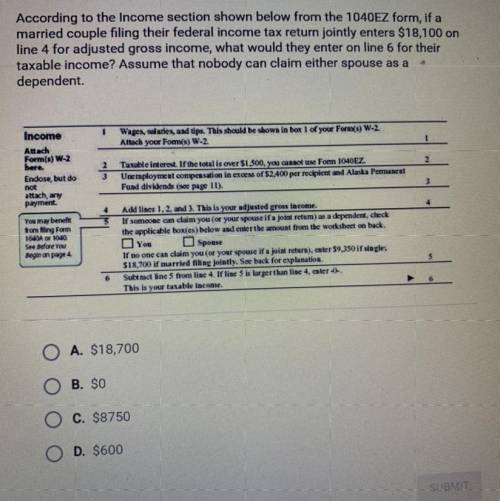

According to the Income section shown below from the 1040EZ form, if a

married couple filing their federal income tax return jointly enters $18,100 on

line 4 for adjusted gross income, what would they enter on line 6 for their

taxable income? Assume that nobody can claim either spouse as a

dependent.

A.18,700

B.0

C.8,750

D.600

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:00

A. 90 degrees b. 45 degrees c. 30 degrees d. 120 degrees

Answers: 2

Mathematics, 21.06.2019 18:00

The sat and act tests use very different grading scales. the sat math scores follow a normal distribution with mean 518 and standard deviation of 118. the act math scores follow a normal distribution with mean 20.7 and standard deviation of 5. suppose regan scores a 754 on the math portion of the sat. how much would her sister veronica need to score on the math portion of the act to meet or beat regan's score?

Answers: 1

Mathematics, 21.06.2019 19:30

Combine the information in the problem and the chart using the average balance method to solve the problem.

Answers: 2

You know the right answer?

According to the Income section shown below from the 1040EZ form, if a

married couple filing their...

Questions

History, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

History, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

History, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Spanish, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Social Studies, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Health, 25.06.2019 23:30

Health, 25.06.2019 23:30

Mathematics, 25.06.2019 23:30

Biology, 25.06.2019 23:30