Mathematics, 31.10.2020 08:30 mhaniyahn

2. Alisha Gregory is a telephone installer. She is married and claims 2 allowances. Her state personal exemptions total $76.92 per week. The state tax rate is 3.0% of taxable income. Local income tax is 1.5% of gross. Medical insurance costs $1,940 a year, of which the company pays 60%. DEPT. EMPLOYEE Gregory A TAX DEDUCTIONS FICA MED. STATE CHECK #WEEK ENDING GROSS PAY NET PAY 8002 6/10/ $640.00 PERSONAL DEDUCTIONS LOCAL MEDICAL UNION DUES OTHER $4.50 $7.50

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

Aformual for 8 bottles of window cleaner calls for 6 cups of rubbing to customers alcohol 2 1/4 gallons of water and 1 1/2 cups of ammonia alcohol would the forula call if a factory made 1,280 bottles for stores to sell to customers

Answers: 1

Mathematics, 21.06.2019 16:00

Which is the standard form for this number? (4 x 1 100 ) + (8 x 1 1,000 ) + ( 3 x 1 100,000 ) ? a) 0.004803 b) 0.04803 c) 0.0483 d) 0.483

Answers: 1

Mathematics, 21.06.2019 16:00

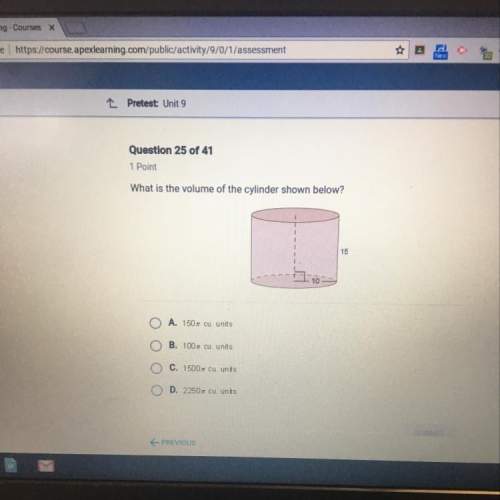

Determine the volume of a cylinder bucket if the diameter is 8.5 in. and the height is 11.5 in.

Answers: 1

Mathematics, 21.06.2019 18:00

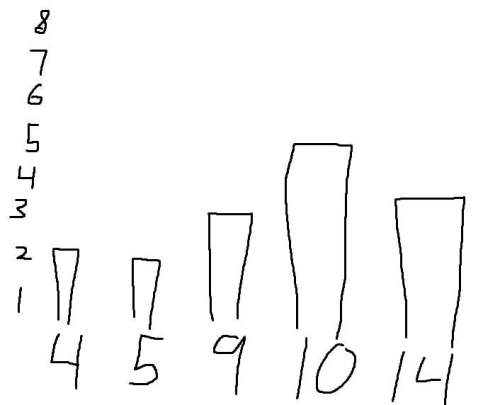

Need on this geometry question. explain how you did it.

Answers: 1

You know the right answer?

2. Alisha Gregory is a telephone installer. She is married and claims 2 allowances. Her state person...

Questions

Mathematics, 04.08.2019 09:20

Social Studies, 04.08.2019 09:20

History, 04.08.2019 09:20

Mathematics, 04.08.2019 09:20

Chemistry, 04.08.2019 09:20

History, 04.08.2019 09:20

History, 04.08.2019 09:20