Mathematics, 16.02.2021 01:50 brae72

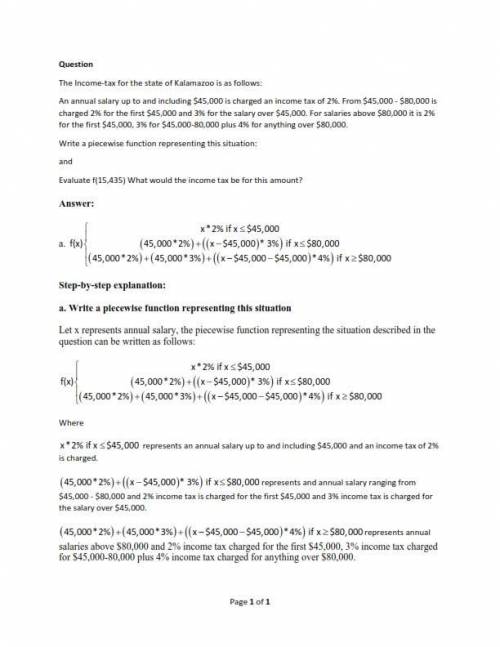

The Income-tax for the state of Kalamazoo is as follows:

An annual salary up to and including $45,000 is charged an income tax of 2%. From $45,000 - $80,000 is charged 2% for the first $45,000 and 3% for the salary over $45,000. For salaries above $80,000 it is 2% for the first $45,000, 3% for $45,000-80,000 plus 4% for anything over $80,000.

Write a piecewise function representing this situation:

and

Evaluate f(15,435) What would the income tax be for this amount?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

The marriott family bought a new apartment three years ago for $65,000. the apartment is now worth $86,515. assuming a steady rate of growth, what was the yearly rate of appreciation? what is the percent of the yearly rate of appreciation?

Answers: 1

Mathematics, 21.06.2019 18:00

For a field trip to the zoo, 4 students rode in cars and the rest filled nine busess. how many students were in each bus if 472 students were on the trip

Answers: 1

Mathematics, 21.06.2019 18:40

The table shows the results of three plays in a football game. what is the net result of the three plays? football game 1st play 5 yards 2nd play -9 yards 3rd play 12 yards

Answers: 2

Mathematics, 21.06.2019 19:30

Find the commission on a $590.00 sale if the commission is 15%.

Answers: 2

You know the right answer?

The Income-tax for the state of Kalamazoo is as follows:

An annual salary up to and including $45,0...

Questions

History, 28.05.2020 18:02

Mathematics, 28.05.2020 18:02

Mathematics, 28.05.2020 18:02

Biology, 28.05.2020 18:02

English, 28.05.2020 18:02

Advanced Placement (AP), 28.05.2020 18:02

History, 28.05.2020 18:02