Mathematics, 07.04.2022 02:40 shradhwaip2426

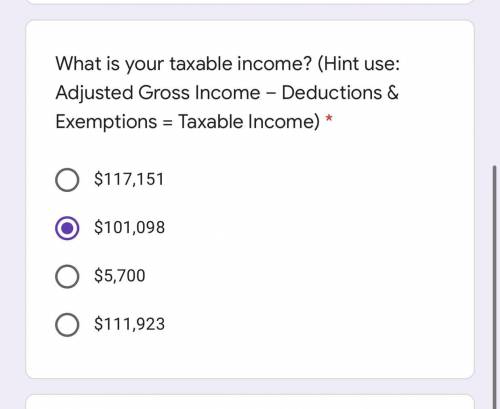

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption and can take a deduction of $2,713 for interest on your mortgage, an adjustment of $2,791 for business losses, an adjustment of $1,346 for alimony, a deduction of $2,086 for property taxes, a deduction of $2,376 for contributions to charity, and an adjustment of $1,091 for contributions to your retirement fund. The standard deduction for a single filer is $5,700, and exemptions are each worth $3,650.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

1. there are 25 students who started computer programming in elementary school and 25 students who started computer programming in middle school. the first group had a mean final project grade of 95% and the second group had a mean final project grade of 92%. the line plot shows the differences after 10 rerandomizations. determine whether the difference in the means of the two groups is significant based on the line plot. explain your answer.

Answers: 1

Mathematics, 21.06.2019 18:20

Cot(90° − x) = 1 the value of x that satisfies this equation is °. a. 60 b. 135 c. 225 d. 315

Answers: 1

Mathematics, 21.06.2019 19:00

Write the pair of fractions as a pair of fractions with a common denominator

Answers: 3

Mathematics, 21.06.2019 21:00

If a is a nonzero real number then the reciprocal of a is

Answers: 2

You know the right answer?

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption a...

Questions

History, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Spanish, 01.06.2020 18:58

French, 01.06.2020 18:58

Social Studies, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Computers and Technology, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Mathematics, 01.06.2020 18:58

Social Studies, 01.06.2020 18:58

Social Studies, 01.06.2020 18:58