Business, 07.10.2020 23:01 sherlyngaspar1p9t3ly

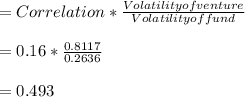

In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broad-based fund of stocks and other securities with an expected return of and a volatility of . Currently, the risk-free rate of interest is . Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of , a volatility of , and a correlation of with the Tanglewood Fund. Calculate the required return and use it to decide whether you should add the venture capital fund to your portfolio. The required return is nothing%. (Round to two decimal places.) Use the result of the above calculation to determine whether you should add the venture capital fund to your portfolio. Should you add the venture fund to your portfolio?

Answers: 2

Another question on Business

Business, 23.06.2019 07:40

If airlines do not change their prices how else might they try to compete with each other?

Answers: 3

Business, 23.06.2019 19:50

Knowledge check 01 taylor company has current sales of 1,000 units, at a selling price of $190 per unit, variable costs per unit of $76 and fixed expenses of $96,000. the company believes sales will increase by 300 units, if the company introduces sales commissions as an incentive for the sales staff. the change will decrease the selling price to $175 per unit, increase variable cost per unit to $100 and decrease fixed expenses by $20,000. what is the net operating income after the changes? increase of $21,500 decrease of $30,000 increase of $24,500 decrease of $22,000

Answers: 3

Business, 23.06.2019 21:00

Type the object of the prepositional phrase that appears in capital letters. marcy plans to select a worthy charity and offer to with fund-raising events.

Answers: 1

You know the right answer?

In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broad-base...

Questions

Biology, 31.07.2019 17:40

Biology, 31.07.2019 17:40

Health, 31.07.2019 17:40

Social Studies, 31.07.2019 17:40

Social Studies, 31.07.2019 17:40